Check Out The Equities Tear Sheet in the PDF below. Also, check out the link to our TTP model that has crushed the S&P 500 in backtests, and deploys risk adjusted tactics to deliver amazing risk-adjusted returns with downside protection!

State of The Equity Market - June 29th, 2025

Market Health: Technical conditions showing stabilization as the S&P 500 has recovered back above the psychologically important 6,000 level, representing improved price action from previous week's weakness. Market breadth remains a concern with the composite market breadth Z-score still in negative territory, though the recovery above 6,000 suggests potential for improving participation if the advance can broaden beyond narrow leadership.

Sentiment & Positioning: Contrarian indicators remain constructive with speculator positioning Z-scores continuing to show bearish extremes below -2, indicating persistent pessimism among large traders and hedge funds. This deeply bearish positioning provides significant contrarian fuel for continued rallies, particularly as price action has begun to diverge positively from the extreme negative sentiment readings.

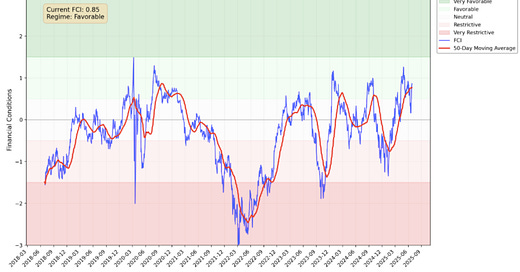

Financial Conditions: Significantly improved to favorable territory at 0.85, representing a substantial upgrade from previous neutral readings and providing strong support for risk assets. Favorable conditions historically generate positive returns with 77% win rates and 8%+ average returns over 3-month periods, creating a much more supportive backdrop for equity performance with materially reduced downside risk.

Volatility Regime: Markets maintain the beneficial low volatility environment with 1-month realized volatility below 3-month levels. This regime continues to support wealth creation phases, having generated 320%+ cumulative returns since 2010. The combination of low volatility with improving financial conditions provides an increasingly supportive environment for risk asset appreciation.

Key Developments: The S&P 500's recovery above 6,000 coincides with favorable financial conditions upgrade, creating more compelling risk/reward dynamics. International markets (EFA, EEM) continue to lead in relative performance while QQQ shows improving momentum and SPY remains in lagging territory with improving momentum. Technology (XLK) demonstrates strong upward momentum in the improving quadrant, while small caps (IWM) join the improving quadrant and high beta (SPHB) shows exceptional momentum recovery. Growth (IWF) has moved into leading territory.

Investment Implication: Improving technical conditions combined with favorable financial conditions and extreme bearish positioning creates an increasingly attractive tactical opportunity. The upgrade in financial conditions significantly reduces downside risk while maintaining upside potential. Consider increased exposure through technology recovery (XLK), small cap momentum (IWM), leading growth strategies (IWF), international leadership (EFA/EEM), and high beta momentum (SPHB) while the supportive low volatility regime and favorable financial backdrop provide risk management support.